Tow Truck Insurance: Everything You Need to Know [2024]

Tow truck insurance is a crucial aspect of running a towing business, providing coverage for the unique risks associated with towing operations. Here’s an overview of everything you need to know about tow truck insurance as of 2024.

Types of tow truck insurance

1.Liability Insurance:

- Bodily Injury Liability: Covers medical expenses and legal fees if your tow truck is involved in an accident that causes injury to others.

- Property Damage Liability: Covers damage to other people’s property caused by your tow truck.

2.Physical Damage Insurance:

- Collision Coverage: pays for repairs to your tow truck if it is damaged in a collision with another vehicle or object.

- Comprehensive Coverage: Covers non-crash episodes like robbery, defacing, or catastrophic events.

3.On-Hook Insurance:

- Covers damage to the vehicle being towed while it’s hooked up to your tow truck.

4.Garage keepers Insurance:

- Protects the vehicles left in your custody for storage or repairs.

5.Uninsured/Underinsured Motorist Coverage:

- Provides coverage if your tow truck is involved in an accident with a driver who has insufficient or no insurance.

6.Medical Payments Coverage:

- Covers clinical costs for yourself as well as your travelers in the event of a mishap.

7.Motor Truck Cargo Insurance:

- Protects the cargo being towed in case of damage or theft.

Factors Influencing Tow Truck Insurance Rates

1.Driving Record

A spotless driving record can prompt lower insurance installments.

2.Type of Towing Operation

Rates may vary based on whether you perform light-duty, medium-duty, or heavy-duty towing.

3.Coverage Limits and Deductibles

Higher inclusion cutoff points and lower deductibles as a rule result in higher expenses.

4.Location

Operating in urban areas or regions with higher accident rates may lead to higher premiums.

5.Experience and Training

Experienced and well-trained drivers may qualify for lower insurance rates.

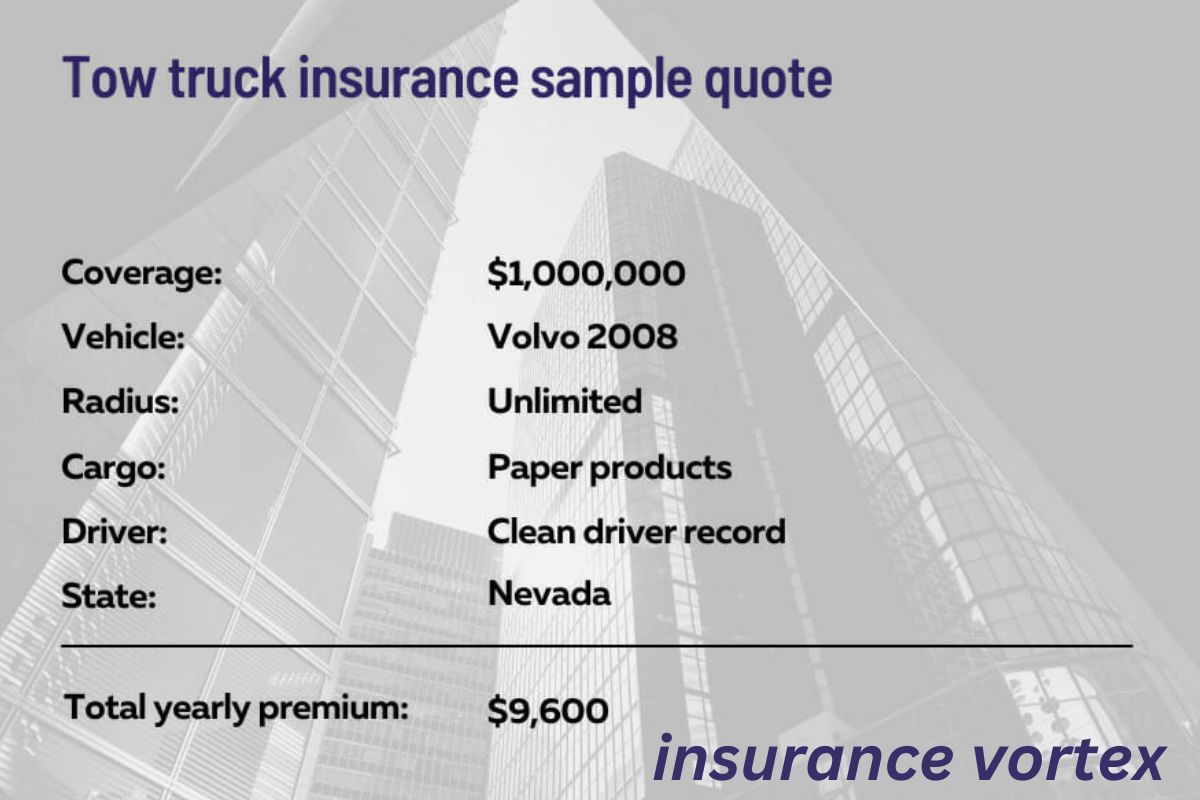

How Much Does Tow Truck Insurance Cost?

Tow truck responsibility protection begins as low as $300,000 and goes up to $1 million. The typical month to month cost for tow truck protection is $450.

Each business is unique, requiring different inclusion to safeguard itself from chances. Very much like your tow truck business is unique in relation to the one down the block. While ascertaining the expense of your tow truck protection, insurance agency considers a few elements:

- The quantity of trucks you want to guarantee

- Your trucks size, age, model, and condition

- The experience and driving record of any individual who will be working the vehicle

- Your yearly inclusion and courses you will cover The sorts of burdens you will pull.

| How do I get tow truck insurance coverage? |

It’s easy to get insurance for your towing business or repair shop if you have basic information on hand. Our application will ask for basic facts about your company, such as revenue and number of employees. You can buy a policy online and get certificate of insurance with Insure on in three easy steps:

- Complete a free online application.

- Compare insurance quotes and choose policies.

- Pay for your policy and download a certificate.

Insureon’s licensed insurance agents work with top-rated U.S. providers to find the right type of coverage for tow truck operators, whether you work independently or hire employees.

Why is commercial insurance important for tow truck businesses?

Commercial insurance is crucial for tow truck businesses for several reasons, providing essential protection against the unique risks associated with their operations. Here are key reasons why commercial insurance is important for tow truck businesses:

1.business Interruption Protection:

In the event of accidents or other covered incidents that disrupt business operations, commercial insurance provides coverage for lost income and ongoing expenses. This ensures that the tow truck business can continue to operate even during challenging circumstances.

2.Employee Safety:

Tow truck businesses employ drivers and staff who may be exposed to various risks while on the job. Commercial insurance, including workers’ compensation, provides coverage for injuries or accidents involving employees, promoting a safer work environment and protecting the business from potential legal claims.

3.Regulatory Compliance:

Many jurisdictions have specific insurance requirements for tow truck businesses to operate legally. Commercial insurance helps businesses comply with these regulations, avoiding legal issues and ensuring that they can continue their operations without interruptions.

4.Customer Confidence:

Clients often prefer to work with tow truck businesses that are adequately insured. Commercial insurance gives customers confidence that their vehicles are in safe hands and that they will be compensated for any damages incurred during the towing process. This can enhance the business’s reputation and attract more clients.

5.Financial Stability:

Unforeseen events, accidents, or legal issues can pose significant financial challenges to tow truck businesses. Commercial insurance provides a safety net, helping maintain financial stability by covering the costs associated with liabilities, property damage, or other unexpected events.

| Coverage of Towing |

Towing insurance coverages are an essential component of an auto insurance policy, providing valuable protection in situations where your vehicle requires assistance on the road. Whether it’s a breakdown, flat tire, or another roadside emergency, having the right towing coverage can save you from significant out-of-pocket expenses and the stress of being stranded. In this comprehensive guide, we’ll explore various towing insurance coverages to help you understand their significance and how they can benefit you.

1.Towing and Labor Coverage:

Towing and labor coverage is a fundamental component of towing insurance. This coverage helps offset the costs associated with towing your vehicle to a repair facility when it experiences a breakdown. In addition to towing expenses, it often covers other roadside assistance services such as jump-starts, tire changes, and lockout assistance. Towing and labor coverage offer financial relief when unexpected mechanical failures leave you stranded on the side of the road.

2. Roadside Assistance:

Roadside assistance is a broader coverage that extends beyond towing. It encompasses a range of services designed to help you with various roadside emergencies. In addition to towing, roadside assistance can include services like fuel delivery, battery jumps, flat tire changes, and more. This coverage ensures that you have comprehensive support in the event of unexpected issues while driving.

3. Emergency Road Service:

Emergency Road service coverage is similar to roadside assistance and provides help for common problems that can occur while driving. This coverage may be included as part of your auto insurance policy or offered as a standalone service. Emergency road service is designed to address immediate needs, offering peace of mind and swift assistance when you need it most.

4. Auto Club Memberships:

Some insurance providers offer auto club memberships that incorporate towing services along with other benefits. Joining an auto club can be an alternative way to access towing assistance and additional perks like discounts on travel, lodging, and more. Auto club memberships often provide a broader range of services beyond basic towing, making them a valuable option for drivers seeking comprehensive assistance packages.

4.Rental Reimbursement:

While not directly related to towing, rental reimbursement coverage is worth considering in the context of overall protection. If your vehicle requires significant repairs and is out of commission, rental reimbursement can help cover the cost of renting a temporary replacement vehicle. This ensures that you can continue with your daily activities while your primary vehicle is in the shop.

6. Comprehensive and Collision Coverage:

While not specific to towing, comprehensive and collision coverages are crucial for overall vehicle protection. Comprehensive coverage protects your vehicle against non-collision events such as theft, vandalism, or natural disasters, while collision coverage addresses damages resulting from accidents. Having these coverages ensures that your vehicle is safeguarded in various scenarios, complementing towing coverages for a more comprehensive insurance package.

7.Trip Interruption Coverage:

Trip interruption coverage is an often overlooked but valuable addition to towing insurance. This coverage helps reimburse you for expenses incurred due to a covered breakdown or accident that happens away from home. It may cover costs such as lodging, meals, and transportation while your vehicle is being repaired. Trip interruption coverage ensures that unexpected vehicle issues don’t turn a road trip into a financial burden.

8. On-Hook Towing Insurance:

For those who operate tow trucks or engage in towing services as a business, on-hook towing insurance is essential. This coverage protects the vehicle you are towing while it’s in transit. Whether you’re towing a customer’s disabled vehicle or transporting a car for repairs, on-hook towing insurance ensures that damages to the towed vehicle are covered.

9. Storage Fee Coverage:

In some cases, your vehicle may need to be stored at a facility after being towed. Storage fee coverage can help cover the costs associated with storing your vehicle at a repair shop or towing yard. This coverage is particularly important if there are delays in the repair process or if you need time to make decisions about the vehicle’s future.

10. Geographic Towing Limits:

When selecting towing insurance, it’s crucial to be aware of any geographic towing limits specified in the policy. Some insurance providers may limit the distance for towing services, especially for basic coverage. If you frequently travel long distances or live in a rural area, consider opting for towing insurance with broader geographic coverage to ensure assistance is available wherever you go.

11. Additional Service Providers:

Check if your towing insurance allows you to choose from a network of approved towing service providers or if it limits you to specific companies. Having the flexibility to choose a reputable and reliable towing service in your area can be beneficial, ensuring that you receive prompt assistance from a trusted provider.

12. Exclusions and Limitations:

Carefully review the exclusions and limitations of your towing insurance policy. Some policies may have restrictions on the types of vehicles covered or specific circumstances where coverage may be limited. Understanding these details will help you make informed decisions and avoid surprises when you need to use your towing insurance.

Conclusion:

In summary, towing insurance encompasses a range of coverages designed to protect you and your vehicle in various roadside situations. From basic towing and labor coverage to specialized options like on-hook towing insurance, considering your specific needs and potential scenarios is crucial when selecting the right coverage. Take the time to review the terms, limitations, and additional benefits of each coverage type to build a comprehensive towing insurance package that suits your driving habits and lifestyle. By doing so, you can enjoy the peace of mind that comes with knowing you’re well-prepared for unexpected events on the road.

What is the meaning of towing coverage?

an optional coverage you can add to your car insurance that typically protects you against some of the costs and hassles associated with common roadside breakdowns.

What are the benefits of tow haul?

on downhills, Tow/Haul mode selects a lower gear for a stronger engine-braking effect. This reduces the demands on the brakes, which reduces the odds of the brake pads or fluid overheating. Second, the gearbox won’t shift as much as it would regularly, which helps keep transmission temperatures at a safe level.