Equipment Rental & Sales Insurance.

Gear protection gives inclusion to the maintenance or substitution of important business hardware in case of harm, robbery, or other unanticipated conditions. This sort of protection can be essential for organizations that depend vigorously on hardware to work, for example, development organizations, producers, or clinical offices. Strategies regularly cover an extensive variety of gear, including hardware, PCs, devices, and particular instruments. The inclusion might stretch out to hardware situated nearby, on the way, or briefly put away somewhere else. Contingent upon the arrangement, inclusion might incorporate the expense of fixes or substitution as well as business interference costs brought about because of gear personal time. By alleviating monetary misfortunes related with gear harm or misfortune, hardware protection assists organizations with keeping up with activities and limit interruptions, eventually shielding their productivity and progression.

Equipment Insurance.

Gear protection is fundamental for organizations that rely vigorously upon their instruments and hardware to keep tasks running Hardware protection is an essential type of inclusion for organizations that depend intensely on their devices and gear to keep their tasks running. It pays out the expense to fix or supplant fundamental things assuming these are inadvertently harmed or lost. Yet, this kind of strategy offers an expansive scope of security. Understanding what’s covered and what isn’t is vital to tracking down the right inclusion for your requirements. In this article, Protection Business digs further into what gear protection covers. We will give you a walkthrough of what things are incorporated, which episodes are covered, and what costs your strategy will pay for. Peruse on and look further into how this significant type of business protection can safeguard you.

Equipment insurance policies c Gear protection.

covers a wide cluster of devices and hardware utilized in your business’ day to day tasks. Inclusion goes from little gadgets to enormous apparatus as long as these things meet three significant rules.

1. The items must be movable.

Gear protection is a sort of inland marine protection, which covers products while they are being moved ashore. This implies that it covers just things that can be moved starting with one spot then onto the next, as a rule from your business’ essential office area to various places of work. Equipment insurance is also referred to as contractor’s tools and equipment insurance or equipment floater insurance. As the second name suggests, it is a floating policy, meaning coverage “floats” with your equipment wherever it goes.

2. The items must be worth less than $10,000.

Most hardware insurance strategies have an inclusion cutoff of $10,000, which is the greatest sum it will pay for the contract time frame. High-esteem, first in class gear is seldom covered. Yet, for strategies that do, inclusion as a rule comes at a precarious cost.

Equipment insurance – covered items.

Hardware protection covers a huge scope of things from little manual instruments to enormous apparatus. Here is a rundown of the various classifications that such strategies regularly cover.

Power devices:

Air blowers, point processors, roll joiners, roundabout saws, drills, influence drivers, drills, mailers, and responding saws.

Large equipment:

Excavators, tractors, concrete blenders, compactors, cranes, earthmovers, forklifts, graders, pavers, farm trucks, diggers, and wheel loaders

Clothing and defensive stuff:

Hard caps, hearing assurance, high-perceivability vests, defensive dress, respirators, wellbeing gloves, security goggles, wellbeing saddles, and wellbeing shoes.

Various hardware:

Hand trucks, stepping stools, sawhorses, framework, stand lights, tool compartments, push carts, and workbenches.

PC hardware:

Camcorders, copiers, personal computers, workstations, screens, projectors, and tablets few strategies likewise cover devices and hardware that your business acquired or leased.

The items must be less than five years old.

Equipment insurance policies pay out for the repair and replacement costs of your tools and equipment in two ways:

Replacement cost value (RCV) equipment insurance:

Pays out a sum equivalent to the amount it would take to supplant the lost or harmed thing with another one.

Most strategies give inclusion to instruments and gear that are under five years of age. A few strategies, notwithstanding, likewise pay out the maintenance and swap costs for more established things, however just on a real money esteem premise. In this way, at last your devices and gear will progress in years out of the substitution esteem choice

Equipment insurance – covered costs.

Apparatuses and hardware protection furnishes your business with the essential monetary assurance in the occasion gear harm takes steps to crash your activities. Here are a portion of the costs covered by these strategies.

Fix and substitution costs:

Contingent upon how old the things are, gear protection might pay out the genuine money worth or substitution cost worth of your devices and hardware. Things under five years of age are generally paid on a substitution esteem cost premise, while more established gear is covered on a genuine money esteem premise

Lost pay:

A few strategies pay out for the pay that you lost since gear harm has made your tasks stop. Inclusion normally begins from the hour of the occurrence until the gear has been fixed or supplanted.

Project delays:

Gear protection covers extra costs your business causes because of an undertaking postpone brought about by harmed hardware. A few strategies likewise give inclusion to unexpected supplies or administrations expected to keep the task on time.

Tidy up and trash expulsion:

On the off chance that gear harm causes a significant wreck, a few strategies pay out for the expense to tidy up or eliminate the garbage.

Compensation for data:

Some gear insurance contracts will repay you for the expense of a prize that prompts the arrival of taken hardware or the capture of the criminal.

The table below sums up what an equipment insurance policy covers.

Equipment insurance – covered incidents.

Hardware protection is many times composed on an all-gambles with premise. This implies that inclusion might incorporate episodes not explicitly recorded in your strategy archive. A portion of the occasions most instruments and hardware insurance contracts cover include.

Robbery:

Strategies cover episodes of burglary that happen hands on location, while your instruments and hardware are being moved, and keeping in mind that they are inside a storeroom.

Unplanned harm:

Occurrences where a worker inadvertently breaks or harms hardware while going about their responsibilities are covered. Strategies likewise pay out misfortune or harm brought about by unanticipated episodes, for example, a water release harming your influence devices or PC hardware.

Catastrophic events:

Gear protection covers misfortune or harm brought about by normal disasters like tempests, hail, lightning, and rapidly spreading fire. Contingent upon the area, a few strategies don’t naturally incorporate flooding and tremor harm, despite the fact that inclusion can be reached out through riders.

Defacement:

Destructive incidents that cause harm to your devices and gear while on travel or at the place of work are covered.

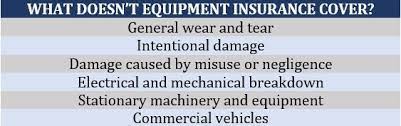

The excluded from an equipment insurance policy.

Equipment insurancenotwithstanding, doesn’t cover each gadget and apparatus that you use for your business and each episode that causes harm. Here are a portion of the normal rejections from your instruments and gear strategy:

Ordinary mileage:

Approaches don’t pay out assuming the harm is brought about by normal weakening. These incorporate rust, consumption, and electrical or mechanical breakdown.

Purposeful harm:

Hardware protection won’t cover devices and gear that are intentionally harmed by your staff. Essentially, in the event that the things are abused or harmed on account of carelessness, your strategy won’t pay out for the expense to fix or supplant them.

Electrical and mechanical breakdown:

Hardware insurance doesn’t regularly cover electrical or mechanical breakdown, albeit a few contracts might permit you to broaden inclusion at an extra expense. For these sorts of harm, you want a different strategy called hardware breakdown protection.

Fixed hardware:

Apparatuses and gear protection covers just things that can be shipped to various worksites. Stable gear and hardware are not covered, albeit these might be remembered for hardware breakdown strategies.

Business vehicles:

The vehicles your business uses to ship staff and others are not covered under hardware protection. These may incorporate vehicles, trucks, and

vans. For these sorts of vehicles, you really want to take out business accident coverage.

Here is an outline of what devices and hardware protection doesn’t cover.

How does equipment insurance work?

Equipment insurance is a type of policy designed to cover the repair or replacement cost of the tools and equipment essential to your business if these were stolen, vandalized, or accidentally damaged. Coverage may seem straightforward but because of similar elements and overlapping inclusions with other policies, it is sometimes confused with other types of insurance. Here are some of the common misconceptions about tools and equipment insurance.

Equipment insurance covers mechanical and electrical breakdown.

Most strategies don’t cover mechanical and electrical breakdown, which are covered under an alternate kind of strategy called hardware breakdown protection. Some gear insurance contracts, in any case, can be reached out to cover for mechanical or electrical disappointment.

Equipment insurance is the same as inland marine insurance.

Devices and gear protection is really a sort of inland marine protection, which covers products being shipped over land. While inland marine approaches stop inclusion once the things have shown up at their objective, gear protection’s inclusion reaches out to when the apparatuses and hardware are utilized on and put away at the places of work.

Tools and equipment are covered under commercial property insurance?

Standard business property protection covers the apparatuses and hardware that you use for your business as long as they stay inside your essential office area. In any case, they are not generally covered once

they leave the premises. That is the reason having hardware protection is significant for organizations that move fundamental instruments and gear from their base camp to various worksites.

Hardware protection isn’t lawfully needed, albeit different organizations might make it a condition prior to consenting to work with you to safeguard their ventures.

You can buy devices and gear insurance as an independent contract or as a rider to your business property protection or entrepreneur’s contract. The last option is a kind of private venture protection comprising of

general obligation protection, business property protection, and in some cases business interference inclusion.

If you have any desire to dive deeper into how gear protection functions, you can look at our exhaustive manual for apparatus protection.

How much equipment insurance does your business need?

Most equipment insurance contracts have a greatest inclusion cutoff of $10,000, however there are some that permit you to raise the breaking point to cover for more costly gear. Assuming you’re at present working out how much inclusion your business needs, here are an elements that you want to consider:

What instruments and hardware you need to incorporate

How much these instruments and hardware are worth

How old these instruments and hardware are

Where you store these instruments and hardware

How you keep up with these instruments and hardware

Where your business works

How much deductible could you at any point bear to pay

The arrangement’s coinsurance rate

On the off chance that you’re working a beginning up or a private venture, you realize closing down tasks can demonstrate exorbitant. Be that as it may, taking out a few strategies to keep your business appropriately safeguarded can put a scratch on your profit. That is the reason appropriate arranging is significant while working out the inclusion you really want. Assuming that you’re worried about the amount you’ll have to pay for inclusion, our manual for how much private venture protection expenses can help.

Is taking out equipment insurance worth it?

The solution to this question relies upon whether gear protection gives adequate inclusion to the apparatuses and hardware that are fundamental for keep your business running. Aside from paying for the expense to fix or supplant harmed or lost gear, such approaches offer monetary security assuming hardware harm brings about lost pay or undertaking delay.

A few strategies, in any case, are prohibitive on how much inclusion they offer, which makes sense of their generally low charges. This may not be a worry on the off chance that your business doesn’t claim specific, first in class hardware. On the off chance that your business depends on standard instruments and hardware, gear protection might be an advantageous venture.

In any case, apparatuses and gear protection is only one of the few sorts of inclusion that your business should be completely secured. To become familiar with different types of arrangements business ought to have, you can look at our thorough manual for business protection.

Do you suppose gear protection is a significant type of cover? Explain to us why or why not in the remarks segment beneath.