Manufacturing insurance:

Fabricating protection gives fundamental inclusion custom-fitted to the particular dangers faced by producers. This kind of protection shields against potential monetary misfortunes coming about because of property harm, responsibility claims, hardware breakdowns, store network disturbances, and other functional difficulties normal in assembling settings.

Property protection safeguards fabricating offices, hardware, and stock against harm or misfortune because of occasions like fire, burglary, or catastrophic events. Obligation protection covers legitimate costs and harms on the off chance that an outsider is harmed or their property is harmed because of the producer’s tasks or items. Moreover, item responsibility protection safeguards against claims emerging from damaged items hurting shoppers.

Business interference protection assists producers with recuperating lost pay and cover progressing costs on the off chance that tasks are stopped because of a covered occasion, like a fire or hardware disappointment. Gear breakdown protection gives monetary insurance against the expenses of fixing or supplanting failing hardware. IN the present quickly advancing assembling scene, particular arrangements may likewise address arising gambles with like digital dangers, ecological liabilities, and store network disturbances.

By putting resources into extensive assembling protection, organizations can moderate dangers, safeguard resources, and guarantee progression of activities despite unanticipated difficulties.

Best Insurance Policies for Manufacturing Companies.

Property Protection: Inclusion for actual resources like structures, apparatus, gear, and stock against takes a chance with like fire, burglary, or cataclysmic events.

Responsibility Protection: Security against cases of substantial injury or property harm brought about side effects, activities, or premises. This might incorporate item responsibility protection and general obligation protection.

Business Interference Protection: Inclusion for lost pay and continuous costs on the off chance that tasks are intruded on because of covered dangers, like fire or gear breakdown.

Laborers’ Remuneration Protection: Inclusion for clinical costs and lost compensation for representatives who are harmed or become sick while at work.

Item Review Protection: Security against monetary misfortunes related with reviewing flawed items from the market.

Digital Protection: Inclusion for costs connected with information breaks, cyberattacks, and other digital occurrences that can upset assembling activities or compromise delicate data.

Hardware Breakdown Protection: Inclusion for fix or substitution expenses of apparatus and gear harmed by mechanical breakdown or electrical disappointment.

Business Accident protection: Inclusion for vehicles utilized in assembling activities, including conveyance trucks, vans, and other organization-claimed vehicles.

Chiefs and Officials (D&O) Protection: Security for the individual resources of organization chiefs and officials in the event that they are sued for supposed unfair demonstrations in dealing with the business.

Ecological Obligation Protection: Inclusion for costs related to contamination cleanup and natural harm coming about because of assembling exercises. These classifications might change depending on the particular requirements and dangers of the assembling industry. It’s fundamental for makers to work with protection experts to fit inclusion to their one of a kind tasks and openings.

ASSET PROTECTION MANUFACTURING INSURANCE

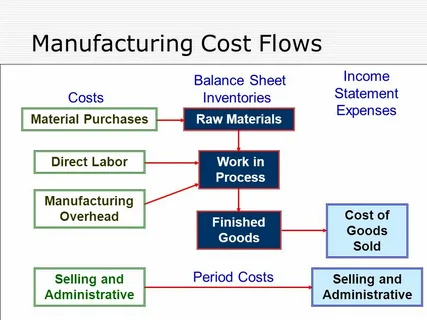

Certainly, when it comes to asset protection in manufacturing insurance, the categories typically include:

Property insurance covers physical assets such as buildings, machinery, equipment, and inventory against various risks like fire, theft, vandalism, or natural disasters.

Equipment breakdown insurance: Protection for repair or replacement costs of machinery and equipment due to mechanical breakdown or electrical failure.

Business interruption insurance: Coverage for lost income and ongoing expenses if operations are interrupted due to covered perils, helping to mitigate financial losses during downtime.

Product liability insurance: Protection against claims arising from bodily injury or property damage caused by products manufactured or sold by the company.

Cyber insurance: Cverage for expenses related to data breaches, cyberattacks, and other cyber incidents that can compromise sensitive information or disrupt manufacturing operations.

Directors and officers (do) insurance: Safeguards the personal assets of company directors and officers in case they are sued for alleged wrongful acts in managing the business.

Environmental liability insurance:

Coverage for costs associated with pollution cleanup and environmental damage resulting from manufacturing activities, ensuring compliance with regulations and mitigating financial risks.

Supply chain insurance:

Protection against losses incurred due to disruptions or failures within the supply chain, such as delays in receiving raw materials or components

Cargo insurance:

Protection against losses incurred due to disruptions or failures within the supply chain, such as delays in receiving raw materials or components

Cargo insurance: Cargo insurance: Trade credit insurance: Cargo insurance

These categories help manufacturers safeguard their assets and mitigate financial risks associated with various aspects of their operations. Manufacturing businesses need to assess their specific risks and work with insurance professionals to tailor coverage accordingly.

Fabricating organizations face numerous remarkable dangers and difficulties. One of the most significant is safeguarding the gear and resources that make the organization effective. To assist with alleviating these dangers, many organizations decide on insurance contracts custom fitted explicitly for assembling organizations. Here are the absolute most ideal choices:

The type of products that are manufactured.

- Manufacturing operations

- Business equipment and property

- Annual business revenue

- Where your business is located

- Risk control measures in place

- Number of employees

- View Costs

Who Needs a Manufacturer Insurance Policy?

Several entities within the manufacturing industry benefit from having a manufacturer insurance policy:

1. Manufacturers:

This includes companies involved in the production of goods, whether they are raw materials, components, or finished products.

2. Wholesalers and Distributors:

Businesses that distribute or sell manufactured goods to retailers or other businesses can also benefit from manufacturer insurance to protect against liabilities related to the products they handle.

3. Contract Manufacturers:

These are companies hired by other businesses to produce goods on their behalf. Contract manufacturers may still need insurance to protect against liabilities arising from the manufacturing process.

4. Suppliers of Raw Materials or Components.

Entities that supply raw materials or components used in manufacturing processes may require insurance to protect against potential liabilities related to the materials they supply.

5. Exporters:

Manufacturers who export their products may need specialized insurance coverage to protect against risks associated with international trade, such as shipping-related losses or political risks.

6. Small and Medium-Sized Enterprises (SMEs):

Both small and medium-sized manufacturing businesses may need insurance coverage to protect their assets, operations, and liabilities.

7. Large Corporations:

Larger manufacturing corporations also require comprehensive insurance coverage to protect their extensive operations, assets, and liabilities.

In summary, anyone involved in the manufacturing process, whether they are directly manufacturing goods or are part of the supply chain, can benefit from having a manufacturer insurance policy tailored to their specific needs and risks.

To obtain manufacturing insurance coverage for your business, follow these steps:

To obtain manufacturing insurance coverage for your business, follow these steps:

Assess Your Insurance Needs Evaluate the specific risks and liabilities associated with your manufacturing operations. Consider factors such as the type of products you manufacture, the size of your business, the number of employees, your location, and any regulatory requirements.

Research Insurance Providers Look for insurance companies or brokers that specialize in providing coverage for manufacturing businesses. Consider factors such as their experience, reputation, financial stability, and the range of insurance products they offer.

Request Quotes Contact multiple insurance providers to request quotes for the coverage you need. Provide detailed information about your manufacturing operations, including the types of products you manufacture, your annual revenue, the size of your workforce, and any previous insurance claims history.

Compare Coverage Options Review the quotes you receive to compare coverage options, limits, deductibles, and premiums. Consider factors such as the breadth of coverage, policy exclusions, and any additional endorsements or riders that may be available.

Customize Your Coverage Work with your chosen insurance provider to customize your coverage to suit your specific needs and budget. Consider adding endorsements or riders for additional protection against specific risks that are relevant to your manufacturing operations.

Review Policy Documents carefully review the terms and conditions of the insurance policies offered, including coverage limits, exclusions, conditions, and any applicable endorsements or riders. Make sure you understand what is covered and what is not covered by each policy.

Purchase Insurance Coverage Once you have selected the insurance policies that best meet your needs, complete the necessary paperwork and pay the premiums to purchase coverage. Make sure to keep copies of your policy documents in a secure location for reference.

Regularly Review and Update Coverage Periodically review your insurance coverage to ensure it continues to meet the evolving needs of your manufacturing business. Update your coverage as necessary to reflect changes in your operations, equipment, or other relevant factors.

Work with an Insurance Professional Consider working with an experienced insurance broker or agent who specializes in manufacturing insurance. They can help you navigate the insurance buying process, identify potential risks, and ensure you have the appropriate coverage in place to protect your business.

How much does insurance cost for manufacturers?

The cost of insurance for manufacturers can vary widely depending on various factors such as the size of the business, the type of products being manufactured, the location of the manufacturing facility, the number of employees, the safety measures in place, the claims history, and many other variables.

General liability insurance, product liability insurance, workers’ compensation insurance, property insurance, and business interruption insurance are some common types of insurance that manufacturers typically carry. The cost of each type of insurance can be influenced by factors specific to the manufacturer’s operations.

To get an accurate estimate of insurance costs for a manufacturing business, it’s best to consult with insurance providers or brokers who specialize in commercial insurance. They can assess the specific needs and risks of the manufacturing business and provide quotes tailored to those factors.

Several factors will have an impact on insurance costs, including:

What is manufacturing coverage?

Manufacturing coverage refers to insurance policies designed specifically to protect manufacturing businesses from various risks and liabilities associated with their operations. These policies are tailored to address the unique risks faced by manufacturers, which can include product liability, property damage, equipment breakdown, business interruption, and more. Manufacturing coverage typically includes a combination of different insurance policies to provide comprehensive protection for the business and its assets.

What are the 3 types of manufacturing?

- Continuous Manufacturing

- Batch Manufacturing

- Custom Manufacture

What is manufacturing risk?

Manufacturing risk refers to the potential for adverse events or circumstances that can impact the operations, assets, or financial stability of a manufacturing business. These risks can arise from various sources and can have a significant impact on the success and viability of the manufacturing operation. Some common manufacturing risks include.

Supply Chain Disruptions: Manufacturing businesses rely on complex supply chains to source raw materials, components, and other inputs. Disruptions in the supply chain, such as delays, shortages, or quality issues with suppliers, can disrupt production schedules, increase costs, and affect product quality.